Physical and transition climate change risks, including water stress, extreme weather events, temperature rises and increased regulation, may result in increased volatility in the supply of raw materials, production costs, capacity constraints and higher costs of compliance. This year, we have elevated Supply chain disruption as a separate principal risk. We have also merged Geopolitical and Macroeconomic volatility, and Product quality and counterfeit, and have incorporated Data Privacy as part of the overall Business ethics & Integrity risk. This year, we have combined the risk of a pandemic with a business interruption risk. The risk associated with Covid-19 is better understood, however the risk of a new pandemic is possible. The pandemic risk was elevated from an emerging risk last year. Our overall risk footprint reflects significant external threats, such as geopolitical risks, climate change, digital revolution, and the resulting impact of global uncertainty in many areas. All principal risks have updated descriptions, risk outlooks and mitigating actions. We have combined risks as a result of aligned cause and effect, while simplifying others. This year’s annual review of our principal risk descriptions has resulted in a number of changes.

Additional risks not known to management, or currently deemed to be less material, may also have an adverse effect on the business. They do not comprise all the risks associated with our business and are not set out in priority order. The Board considers principal risks to be the most significant risks faced by the group, including those that are the most material to our performance and that could threaten our business model or future long-term performance, solvency or liquidity.

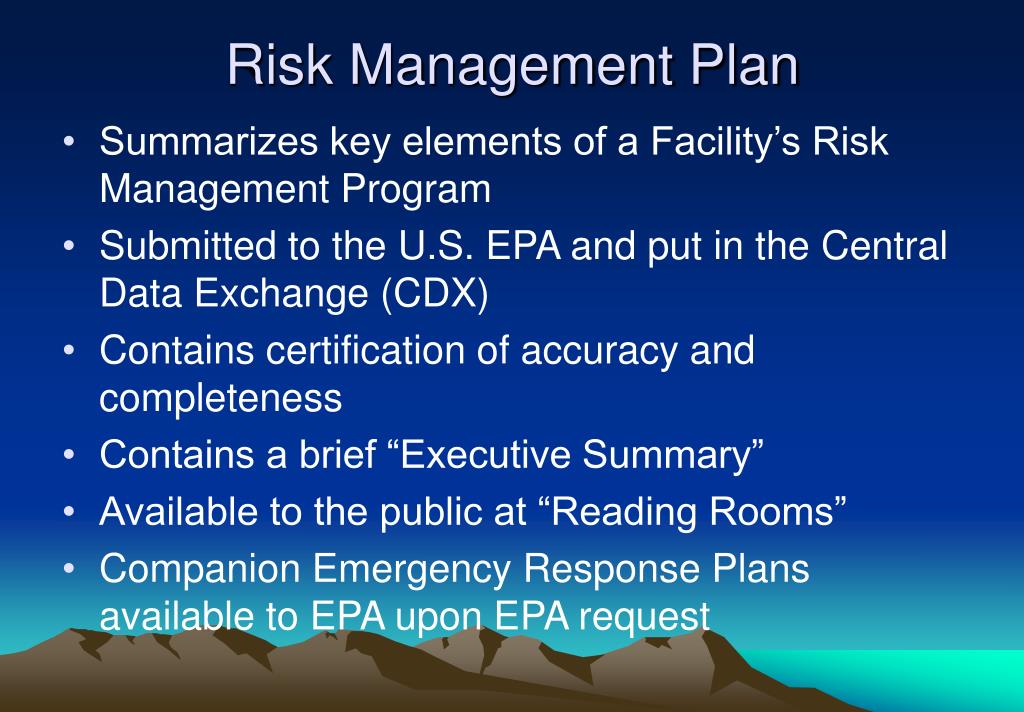

Risk management policy download#

We also establish cross-functional working groups and use expert advice where necessary to ensure significant risks are effectively managed and, where appropriate, escalated to the ARC and Audit Committee for consideration.įor more detail on our risk management approach, download our 2022 Corporate Governance Report (PDF 586KB). We use internal and external data to monitor our risks and to make proactive interventions. The ARC meets quarterly and receives regular reports on the risks faced across the business and the effectiveness of the actions taken to mitigate these risks. Our Executive Audit & Risk Committee (ARC) regularly assesses risk, and the Audit Committee of the Board independently reviews the assessment. Each market and function undertakes an annual risk assessment, establishes mitigation plans and monitors risk on a continual basis. Our approach is also structured to ensure that we take all reasonable steps to mitigate, but not necessarily eliminate, our principal risks in this context.Īccountability for managing risk is embedded into our management structures. We regularly review and refresh our principal risks, our risk appetite, and our approach to risk management. Our risk management efforts aim to be holistic and integrated, bringing together risk management, internal controls and business integrity, ensuring that our activities across this agenda focus on the risks that could have the greatest impact. Our primary focus is to identify and embed mitigating actions for material risks that could impact our current or future performance, and/or our reputation.

0 kommentar(er)

0 kommentar(er)